Mastering Forex Robot Trading: Your Guide to Automated Success

Forex robot trading, also known as automated trading or algorithmic trading, has revolutionized the foreign exchange market. By employing advanced algorithms, traders can execute trades automatically, based on predetermined criteria. This article will delve into the intricacies of Forex robot trading, exploring its benefits, potential risks, and essential strategies to enhance your trading endeavors. If you’re looking for reliable resources, check out the forex robot trading Best International Brokers to find a broker that suits your needs.

What is Forex Robot Trading?

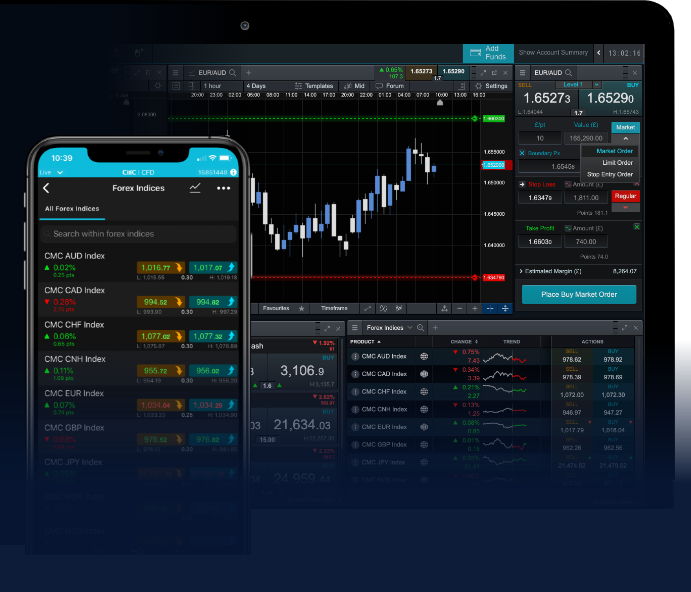

Forex robot trading involves the use of software programs that analyze market conditions and execute trades on behalf of the trader. These robots operate 24/7, which allows them to capitalize on market opportunities at any time, without the need for constant human oversight. Most Forex robots are designed to carry out a specific trading strategy, utilizing technical indicators to predict future price movements based on historical data.

Benefits of Using Forex Robots

1. Emotion-Free Trading

One of the most significant advantages of Forex robots is their ability to trade without emotional interference. Human traders often fall prey to fear and greed, which can lead to impulsive and irrational decisions. In contrast, Forex robots adhere strictly to the trading strategies they are programmed with, allowing for consistent execution of trades regardless of market conditions.

2. Speed and Efficiency

Forex robots can process vast amounts of data and execute trades within milliseconds, far faster than any human trader could. This speed is particularly crucial in the Forex market, where prices can fluctuate rapidly. A robot can capitalize on market movements before they disappear, ensuring that traders do not miss lucrative opportunities.

3. 24/7 Market Monitoring

The Forex market operates around the clock, and it can be challenging for traders to monitor the market continuously. Forex robots can keep track of market conditions and execute trades at any hour, ensuring that traders don’t miss potential profits while they are sleeping or engaged in other activities.

4. Backtesting Capabilities

Most Forex robots allow traders to backtest their strategies using historical data. This feature enables traders to evaluate the performance of a trading strategy before applying it in real-time. Through backtesting, traders can optimize their strategies and fine-tune parameters to improve their chances of success in live trading.

Risks Associated with Forex Robot Trading

1. Software Malfunctions

While Forex robots can automate trading processes, they are still reliant on technology. Software bugs, server outages, or connectivity issues can hinder the robot’s performance and lead to unexpected results. It’s crucial to monitor the robot’s performance regularly and ensure that the software is functioning optimally.

2. Over-Optimization

Many traders might fall into the trap of over-optimizing their robots based on historical data. While this might yield impressive backtest results, it doesn’t guarantee real-world performance. Market conditions are constantly evolving, and a strategy that worked well in the past may not be effective in the future. Traders should maintain a balance between optimization and adaptability.

3. Market Volatility

The Forex market can be highly volatile, and sudden price swings can impact automated trading. If a Forex robot is not adequately programmed to handle extreme market conditions or unexpected events (like economic news releases), it may result in significant losses. Traders should evaluate their robots’ risk management settings to mitigate potential risks.

Choosing the Right Forex Robot

When selecting a Forex robot, consider the following factors:

1. Performance History

Investigate the robot’s performance history. Look for verified results from independent sources, and evaluate how the robot has performed over different market conditions. The past performance of a robot does not guarantee future success, but it can provide insights into its reliability.

2. User Reviews and Testimonials

Research user reviews and testimonials to gauge overall satisfaction with the robot. Look for feedback regarding ease of use, customer support, and the effectiveness of the trading strategy employed by the robot.

3. Transparency

Choose Forex robots that offer transparent trading strategies and algorithms. A reputable robot will typically provide users with detailed information about its trading approach, risk management measures, and any associated fees.

4. Compatibility

Ensure that the Forex robot is compatible with your trading platform. Some robots may only work with specific platforms, so verify that the robot aligns with your chosen broker and trading setup.

Best Practices for Forex Robot Trading

To maximize the potential of your Forex robot trading, implement the following practices:

1. Regular Monitoring

Even though Forex robots operate autonomously, it’s essential to monitor their performance periodically. This will help you identify any discrepancies, malfunctions, or changes in market conditions that may affect the robot’s performance.

2. Diversification

Consider using multiple Forex robots to diversify your trading portfolio. Each robot may specialize in different strategies or currency pairs, which can provide a more balanced approach to risk management.

3. Risk Management

Set appropriate risk management parameters, including stop-loss and take-profit levels. Protecting your trading capital should always be a priority. This will help you minimize losses during unfavorable market conditions.

4. Stay Educated

The Forex market is constantly evolving, and staying informed about market developments, economic indicators, and geopolitical events is crucial. Continuous learning can help you adapt your strategies and improve the performance of your Forex robots.

Conclusion

Forex robot trading offers a powerful means of automating your trading activities in the foreign exchange market. By minimizing emotional interference, executing trades swiftly, and continuously monitoring market conditions, Forex robots can provide significant advantages to traders. However, they are not without risks, and traders must approach automated trading with caution. By choosing the right Forex robot, implementing sound risk management strategies, and staying informed about market changes, you can enhance your trading success in the dynamic world of Forex trading.